As mentioned in this blog, the purpose is for myself to find a way to solidify concepts and make them concrete. There are only a few rules/concepts that I have developed and they are actually simple but, at times difficult to follow.

The reason as to why they are difficult to follow relates to our life principles that influence our thought.

The concept of buying more at higher prices is just plain difficult to say, and if you said it out loud at a party strange looks would ensue. Most people suggest to buy more at lower prices, average down. Sure it makes sense while grocery shopping, it doesn't make sense in trading.

Time Stops are difficult to describe but instrumental in trading. If the market does not react shortly after making a purchase then how good of a trade could it be? If everyone has plenty of time to put on a position and the price is relatively unchanged then how could it be a good trade.

The concept of Next is vital for our ego. Remembering that there are endless supply of good trades, there is no reason to focus on something you were stopped out of weather it be because of time or price. Your mental capital is sometimes more important than your actual money.

Remember what the current bias is. If you can't figure out what the bias is then don't trade. Wait until it is apparent, and once it is determined place some capital in that direction and see how the market reacts. There are many ways to understand the bias, and the way I do is opening range break outs in relation to prior time period pivots. The earlier in the time period the more likely the trend will continue.

Define the time frame you feel comfortable with and in my case I don't really jump around.

Wednesday, December 29, 2010

Tuesday, December 28, 2010

Initiate position, then add

It's hard and even counter intuitive to buy something, see a profit, then add some more and increase your cost basis. If you buy something and it goes up in value why not buy more? Especially if you purchase something and it goes up instantly. What does this tell you? Your correct.

Obviously in the above scenario we have a few things. Broke opening range, held above, and has support below. Also, moving averages are all pointed up. I had to add to this.

"This approach is not for the fainthearted. It puts much emphasis on

proactive trading strategies designed to produce exponential results. It

encourages you to do counterintuitive things—such as admitting uncertainty,

fear, and lack of knowledge and asking for help; sharing information;

and facing vulnerability. All of this means letting go of ego and

arrogance, which blurs your focus on the marketplace."

-Ari Kiev

Sunday, December 26, 2010

Common Weakness

"Each of us is possessed with the common weakness of wanting to have an interest in every jackpot, and we certainly would like to play every hand at bridge. It is this human frailty which we all possess in some degree that becomes the investor’s and speculator’s greatest enemy and will eventually, if not safeguarded, bring about his downfall."

-Reminiscences

Thursday, December 23, 2010

Trade on what you see

"My theory is that behind these major movements is an irresistible force. That is all one needs to know. It is not well to be too curious about all the reasons behind price movements. You risk the danger of clouding your mind with non-essentials. Just recognize that the movement is there and take advantage of it by steering your speculative ship along with the tide. Do not argue with the condition and most importantly don’t combat it."

-Reminiscences

Tuesday, December 21, 2010

When to sell?

I have a good idea as to when to buy, but when do you sell?

Recently I put some money in MCP, and took it off quickly and capitalized on a nice return. http://theopeningrange.blogspot.com/2010/12/instant-10-return.html

BUT, I could of received a much better return with patience and not worrying about losing something I never really had.

Recently I put some money in MCP, and took it off quickly and capitalized on a nice return. http://theopeningrange.blogspot.com/2010/12/instant-10-return.html

BUT, I could of received a much better return with patience and not worrying about losing something I never really had.

"Everybody knew that the way to do that was to take profits and buy back

your stocks on reactions. And that is precisely what I did, or

rather what I tried to do; for I often took profits and waited

for a reaction that never came. And I saw my stock go kiting up

ten points more and I sitting there with my four-point profit

safe in my conservative pocket. They say you never grow poor

taking profits. No, you don't. But neither do you grow rich

taking a four-point profit in a bull market."

your stocks on reactions. And that is precisely what I did, or

rather what I tried to do; for I often took profits and waited

for a reaction that never came. And I saw my stock go kiting up

ten points more and I sitting there with my four-point profit

safe in my conservative pocket. They say you never grow poor

taking profits. No, you don't. But neither do you grow rich

taking a four-point profit in a bull market."

-Reminiscences

Monday, December 20, 2010

If-Rudyard Kipling

If you can keep your head when all about you

Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or, being lied about, don't deal in lies,

Or, being hated, don't give way to hating,

And yet don't look too good, nor talk too wise;

If you can dream - and not make dreams your master;

If you can think - and not make thoughts your aim;

If you can meet with triumph and disaster

And treat those two imposters just the same;

If you can bear to hear the truth you've spoken

Twisted by knaves to make a trap for fools,

Or watch the things you gave your life to broken,

And stoop and build 'em up with wornout tools;

If you can make one heap of all your winnings

And risk it on one turn of pitch-and-toss,

And lose, and start again at your beginnings

And never breath a word about your loss;

If you can force your heart and nerve and sinew

To serve your turn long after they are gone,

And so hold on when there is nothing in you

Except the Will which says to them: "Hold on";

If you can talk with crowds and keep your virtue,

Or walk with kings - nor lose the common touch;

If neither foes nor loving friends can hurt you;

If all men count with you, but none too much;

If you can fill the unforgiving minute

With sixty seconds' worth of distance run -

Yours is the Earth and everything that's in it,

And - which is more - you'll be a Man my son!

-Rudyard Kipling

Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or, being lied about, don't deal in lies,

Or, being hated, don't give way to hating,

And yet don't look too good, nor talk too wise;

If you can dream - and not make dreams your master;

If you can think - and not make thoughts your aim;

If you can meet with triumph and disaster

And treat those two imposters just the same;

If you can bear to hear the truth you've spoken

Twisted by knaves to make a trap for fools,

Or watch the things you gave your life to broken,

And stoop and build 'em up with wornout tools;

If you can make one heap of all your winnings

And risk it on one turn of pitch-and-toss,

And lose, and start again at your beginnings

And never breath a word about your loss;

If you can force your heart and nerve and sinew

To serve your turn long after they are gone,

And so hold on when there is nothing in you

Except the Will which says to them: "Hold on";

If you can talk with crowds and keep your virtue,

Or walk with kings - nor lose the common touch;

If neither foes nor loving friends can hurt you;

If all men count with you, but none too much;

If you can fill the unforgiving minute

With sixty seconds' worth of distance run -

Yours is the Earth and everything that's in it,

And - which is more - you'll be a Man my son!

-Rudyard Kipling

Sunday, December 19, 2010

In the pocket

When a quarterback sits in the pocket for too long how good of play could it be?

When a sleezebag stares at your women for way to long, how good of a sleezebag could he be?

When a sleezebag stares at your women for way to long, how good of a sleezebag could he be?

"In other words, when plotting out your trade, it is not only if a price level is reached but how long the market spends there. The vast majority of traders I know trade on price, but not on time. How many people have you heard say that if you take a position and it doesn’t go anywhere in in 20 or 30 minutes, then you should get out? I’m here to state that time is the most important factor in trading. If the scenario you’ve envisioned doesn’t materialize within a certain time frame, then just move on and look for the next trade."

-Mark Fisher

Saturday, December 18, 2010

Plans

"I’ve observed that very few people operate according to a plan. In the micro sense, too many traders are undisciplined in their trading. They try to pick tops only to have the market keep rallying, or they buy what they think is a dip, only to have the market fall some more. They can not manage their risk, their capital, or themselves. This need to have a trading plan is as important for the novice trader as it is for the experienced professional, and vice versa."

Friday, December 17, 2010

Lapse in Judgement

Here is an investigation of my lapse in logical conclusions. About to set foot for an interview for a promotion in my job. Already confident as my production is top in my region, but still uncomfortable as I am not put on the spot too often.

I find a trade that looks interesting, yet goes against my historically tested opening range/breakout strategy that works.

I placed the trade, and got out of it realizing afterwords what had actually happened.

Sure this can reverse but there are far too many better options out there than this? You always hear the term "learn from your mistakes," I prefer "observe your mistakes."

This works:

I find a trade that looks interesting, yet goes against my historically tested opening range/breakout strategy that works.

I placed the trade, and got out of it realizing afterwords what had actually happened.

This works:

Thursday, December 16, 2010

Blockbuster Video

"* Everyone is wrong in the markets at times. The difference between the great traders and the unsuccessful ones is in how long they stay wrong.

* Addictive traders get high from action; great traders get high from mastering markets--and mastering themselves.

* Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.

* Every loss of discipline is a self-betrayal; great traders are true to themselves and stay disciplined as a result.

* Great traders focus on the two things they can always control: when they play and how much they bet."

-Brett Steenbarger

I've got a friend who I think lost his mind. He got crushed on a contrarian bet on Blockbuster Video. Probably bought a ton of calls at a point in time, and they expired worthless. I can't stand talking to him about investing and avoid it at all costs because he acts like he knows everything.

I'm under the impression that in investing/trading people, me and you, know nothing. We are largely wrong in conclusions no matter what we do. The world evolves quickly in competition, policies, expectations, psychology, greed, etc. that it is extremely difficult to predict the future.

So, I'm talking to my friend who just loaded the boat on this thing again?

It's human nature to want to prove yourself correct. I've had this happen to me before and it's a lesson we should not forget. If the environment proves you wrong and you know you can't change the environment then why try again? (in a particular security issue that is)

Or maybe this is a good risk reward? I just think it's his head playing games based on his historical interaction with this company.

All I can say is good luck.

* Addictive traders get high from action; great traders get high from mastering markets--and mastering themselves.

* Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.

* Every loss of discipline is a self-betrayal; great traders are true to themselves and stay disciplined as a result.

* Great traders focus on the two things they can always control: when they play and how much they bet."

-Brett Steenbarger

I've got a friend who I think lost his mind. He got crushed on a contrarian bet on Blockbuster Video. Probably bought a ton of calls at a point in time, and they expired worthless. I can't stand talking to him about investing and avoid it at all costs because he acts like he knows everything.

I'm under the impression that in investing/trading people, me and you, know nothing. We are largely wrong in conclusions no matter what we do. The world evolves quickly in competition, policies, expectations, psychology, greed, etc. that it is extremely difficult to predict the future.

So, I'm talking to my friend who just loaded the boat on this thing again?

It's human nature to want to prove yourself correct. I've had this happen to me before and it's a lesson we should not forget. If the environment proves you wrong and you know you can't change the environment then why try again? (in a particular security issue that is)

Or maybe this is a good risk reward? I just think it's his head playing games based on his historical interaction with this company.

All I can say is good luck.

Wednesday, December 15, 2010

Cohen

I don't know much about this guy, and nobody really does based on my research. All I know is he crushes it in terms of trading.

I read this recently:

"Steve Cohen (at S.A.C. Capital) had two mantras: keep on moving, don’t be idle and don’t sit on positions. The other unspoken mantra was you are not going to be right all the time. It’s like basketball if a guy waits for the 100% perfect shot he is never going to take the shot. If you are waiting for the perfect trade you are going to too late. You understand there are a lot of different things that go into a good shot or a good investment than setting up the one perfect opportunity."

-Milton Lee former SAC Capital trader

If anyone has any more information on how this guy trades or thinks, please comment.

The closest I got to this guy was reading books written by Ari Kiev, SAC's in house shrink/coach.

I read this recently:

"Steve Cohen (at S.A.C. Capital) had two mantras: keep on moving, don’t be idle and don’t sit on positions. The other unspoken mantra was you are not going to be right all the time. It’s like basketball if a guy waits for the 100% perfect shot he is never going to take the shot. If you are waiting for the perfect trade you are going to too late. You understand there are a lot of different things that go into a good shot or a good investment than setting up the one perfect opportunity."

-Milton Lee former SAC Capital trader

If anyone has any more information on how this guy trades or thinks, please comment.

The closest I got to this guy was reading books written by Ari Kiev, SAC's in house shrink/coach.

Monday, December 13, 2010

An instant 10% return?

I wrote earlier this month on the idea of not to worry about something that you never had in any of life's adventures. something you never had

Today I just experienced the same feeling and I am committed to holding strong. This morning before the market opened I wanted to get long something on the commodity end. I always have a list of stocks I am willing to buy or short and I pulled out my list and of the 150 companies I cover I saw one that fit what I was looking for.

Molycorp: mcp

Here is what I saw:

What has the opposite characteristics at this point in time?

HPQ

Today I just experienced the same feeling and I am committed to holding strong. This morning before the market opened I wanted to get long something on the commodity end. I always have a list of stocks I am willing to buy or short and I pulled out my list and of the 150 companies I cover I saw one that fit what I was looking for.

Molycorp: mcp

Here is what I saw:

- stock showed long bias (above opening range and held above for half duration of defined opening range)

- broke through prior months resistance

- all three moving averages pointing in direction of bias

What has the opposite characteristics at this point in time?

HPQ

Sunday, December 12, 2010

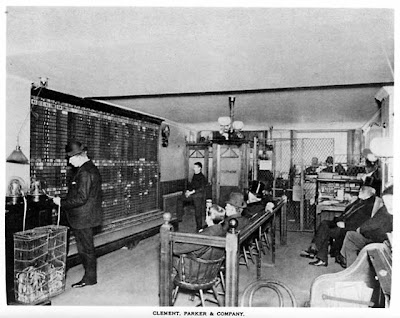

Bucket Shops

"The first ten thousand dollars I made in the bucket shops I lost because I traded in

and out of season, every day, whether or not conditions were

right. I wasn't making that mistake twice. Also, don't forget

that I had gone broke a little while before because I had seen

this break too soon and started selling before it was time. Now

when I had a big profit I wanted to cash in so that I could feel

I had been right."

-Reminiscences

Lately I have been trading well and see myself starting to get a little out of control, just blindly placing bets without a rhyme or reason. That is the point in time you should pull back and withdraw a little bit and this is exactly what I am doing.

The mental game is the hardest part of most sports and is no different here.

Friday, December 10, 2010

Intuition and Markets

Intuition

1.a. The act or faculty of knowing or sensing without the use of rational processes; immediate cognition.

b. Knowledge gained by the use of this faculty; a perceptive insight.

2. A sense of something not evident or deducible; an impression.

Intuition is an extremely abstract concept and putting it to practice is difficult. So if you have intuition you should be good with markets right? Well sure, but instead of trying to develop this characteristic, just let the market do the work.

Markets always react before things actually happen. Now I am not saying that "markets are always correct" but markets in essence already have great intuition. A market is all of the 'brightest' minds making the decision for the price at that very moment.

Markets always react before things actually happen. Now I am not saying that "markets are always correct" but markets in essence already have great intuition. A market is all of the 'brightest' minds making the decision for the price at that very moment.

Let's look at GE over the past few weeks. Now today they just raised their dividend and we saw a 3% move just today. We saw a 12% move in the past two weeks.

Thursday, December 9, 2010

Looking for the next score

"Whenever I read the tape by the light of experience I made money, but when I made a plain fool play I had to lose. There was the huge quotation board staring me in the face, and the ticker going on and people trading and watching their tickets turn into cash or into waste paper. Of course I let the craving for excitement get the better of my judgment."

-Reminiscences

The most difficult thing to do as a trader is to stop trading and slow down the thought processes. When I look back over the past few months almost every one of my trades worked, the thought processes were right on and my tape reading was in sync.

It's the drugs that did it to me, the natural drugs that float around in your brain that get excited when you win, and defensive when you lose. This is what makes your mind cloudy and unable to have a pure view. Sometimes your mind gets on a binge and spirals out of control, this is when you make heavy mistakes. Everyone can look at this complex web of money flows objectively, but never for long without having these drugs and learned youth like processes effect your decision making.

I'm getting better at seeing the warning signs.

-Reminiscences

The most difficult thing to do as a trader is to stop trading and slow down the thought processes. When I look back over the past few months almost every one of my trades worked, the thought processes were right on and my tape reading was in sync.

It's the drugs that did it to me, the natural drugs that float around in your brain that get excited when you win, and defensive when you lose. This is what makes your mind cloudy and unable to have a pure view. Sometimes your mind gets on a binge and spirals out of control, this is when you make heavy mistakes. Everyone can look at this complex web of money flows objectively, but never for long without having these drugs and learned youth like processes effect your decision making.

I'm getting better at seeing the warning signs.

Wednesday, December 8, 2010

Still making the same mistakes

Covered copper short position profitably...great trade but still emblematic to my old wanton style.

Counter trend trading is in essence placing bets against things that have stronger odds. The better trade is simply to buy what is working.

Added to WFC today, because it is working.

Counter trend trading is in essence placing bets against things that have stronger odds. The better trade is simply to buy what is working.

Added to WFC today, because it is working.

Tuesday, December 7, 2010

Tax cuts and weak action?

Today was a strange day, the trend still remains up but I took profits. You can never tell who is in the market but when great news comes out and the market finishes up flat after a strong move early on what does this tell you?

Commodities really took some violent swings, silver, crude, gold, I took profits and shorted Copper.

I don't like to make counter trend bets, but I reacted on the fact that if markets can't make a strong move on this news then what would make the market move?

Commodities really took some violent swings, silver, crude, gold, I took profits and shorted Copper.

Monday, December 6, 2010

Review of learned concepts

The title of this entry is "Review of learned concepts" when in reality I am still trying to learn these ideas. In trading/speculation it seems like you could write a strict list of 4-6 rules and you end up breaking them anyway. Discipline in most ventures is an attribute that is hard to teach and even harder to learn.

I'm writing this review because I am falling back into some old habits that continue to resonate in my mind even after writing this blog and spending vast amounts of time trying to change established customs.

Gambling vs. speculation and how to avoid this natural inclination. Intra-day trading although some are extremely good at this, is truly a vice for me. In most cases it is a reverse ATM because it is just way too difficult to control one's self.

Establishing positions gradually on an increasing line is a strategy that allows not only prudent risk management but, superior returns in my opinion. There is no need to place the entire bet at once, that's gambling not speculation. On top of this you are able to see if your analysis was correct and if so, you can then increase your size accordingly.

Patience, and this kind of coincides with establishing positions gradually. If positions are made in two to three varying purchases (always on an increasing line, if positions is long) then you have time to examine your idea instead of just placing a blind bet on the proverbial 'red or black.'

Following the opening range strategy frankly keeps you on the right side of the market, and more importantly helps you determine when to get out. Looking for stocks, futures, or commodities to in effect show their cards helps you understand who is in the market. Also, staying above or waiting for the market to pierce the prior time periods pivot range is crucial in proper speculation and in a game with few rules helps one stay with current flows of capital. Remember, you can't make money without a trend.

Staying with your chosen time frame is crucial. It is very difficult to juggle multiple time frames and I lack the mental capacity to stay disciplined and move back and forth in time frames that don't have much to do with each other.

Understanding that the mind is your biggest enemy and that our pre-programmed and learned ideas are the main reasons why 98% of people who attempt this fail. The only conclusion that I have drawn is supply and demand cause changes in price, not what you think or even what you think others market participants think. As soon as I gave up trying to out think the market I made money. The conclusions we draw are wrong whether instantly or in the long run because A) the inputs we use are skewed B) We just don't know what everyone else is thinking C) The conclusion you have come to, has already been concluded way before you.

I know you might not all agree with this, and in time as I continue to learn I may alter my 'learned' ideas but I just can't make sense of every market move, and if you try to make sense of the market you will lose your mind. So how do you make money?

I'm writing this review because I am falling back into some old habits that continue to resonate in my mind even after writing this blog and spending vast amounts of time trying to change established customs.

Gambling vs. speculation and how to avoid this natural inclination. Intra-day trading although some are extremely good at this, is truly a vice for me. In most cases it is a reverse ATM because it is just way too difficult to control one's self.

Establishing positions gradually on an increasing line is a strategy that allows not only prudent risk management but, superior returns in my opinion. There is no need to place the entire bet at once, that's gambling not speculation. On top of this you are able to see if your analysis was correct and if so, you can then increase your size accordingly.

Patience, and this kind of coincides with establishing positions gradually. If positions are made in two to three varying purchases (always on an increasing line, if positions is long) then you have time to examine your idea instead of just placing a blind bet on the proverbial 'red or black.'

Following the opening range strategy frankly keeps you on the right side of the market, and more importantly helps you determine when to get out. Looking for stocks, futures, or commodities to in effect show their cards helps you understand who is in the market. Also, staying above or waiting for the market to pierce the prior time periods pivot range is crucial in proper speculation and in a game with few rules helps one stay with current flows of capital. Remember, you can't make money without a trend.

Staying with your chosen time frame is crucial. It is very difficult to juggle multiple time frames and I lack the mental capacity to stay disciplined and move back and forth in time frames that don't have much to do with each other.

Understanding that the mind is your biggest enemy and that our pre-programmed and learned ideas are the main reasons why 98% of people who attempt this fail. The only conclusion that I have drawn is supply and demand cause changes in price, not what you think or even what you think others market participants think. As soon as I gave up trying to out think the market I made money. The conclusions we draw are wrong whether instantly or in the long run because A) the inputs we use are skewed B) We just don't know what everyone else is thinking C) The conclusion you have come to, has already been concluded way before you.

I know you might not all agree with this, and in time as I continue to learn I may alter my 'learned' ideas but I just can't make sense of every market move, and if you try to make sense of the market you will lose your mind. So how do you make money?

- Risk management

- Buy on an increasing line

- Don't gamble

- Understand your conclusions are probably wrong

- Try to understand supply and demand in your time frame

- Be conscious of the Trend

- Understand that this is something you can't understand

- Know where you will get out if you are wrong

Sunday, December 5, 2010

Early in the Month Opening Range Break

1. Determine the bias

The direction the market, stock, security, or commodity breaks is the direction of the bias.

2. Place bet in direction with bias

Your bias remains in direction of break just as long as the market does not break below the opening range (or opposite direction of initial bias that was determined, this works both long and short biases.

3. The most important indicator is the break of the opening range, however you must be conscious of prior time period pivot range as you don't want to bet with this 'wall' in front of you. (if break long, make sure pivot is below or market is slicing through the pivot, this makes for higher probability for profit.

4. Early break of the opening range is of great indication of strong moves in that direction. The hand is showed early and this shows there is great demand for this security. And of course if you can couple this with the pivot range below or if the market is slicing through then you have very strong probabilities of success in betting in that direction.

5. Price is not the end all, Time is almost more important. If there is a break above opening range, market has to hold above this break for half the time of your defined opening range (in the charts below, two days determine the opening range therefore 1 day would have to be in place to determine bias.)

Here are some examples of early break coupled with pivot:

The direction the market, stock, security, or commodity breaks is the direction of the bias.

2. Place bet in direction with bias

Your bias remains in direction of break just as long as the market does not break below the opening range (or opposite direction of initial bias that was determined, this works both long and short biases.

3. The most important indicator is the break of the opening range, however you must be conscious of prior time period pivot range as you don't want to bet with this 'wall' in front of you. (if break long, make sure pivot is below or market is slicing through the pivot, this makes for higher probability for profit.

4. Early break of the opening range is of great indication of strong moves in that direction. The hand is showed early and this shows there is great demand for this security. And of course if you can couple this with the pivot range below or if the market is slicing through then you have very strong probabilities of success in betting in that direction.

5. Price is not the end all, Time is almost more important. If there is a break above opening range, market has to hold above this break for half the time of your defined opening range (in the charts below, two days determine the opening range therefore 1 day would have to be in place to determine bias.)

Here are some examples of early break coupled with pivot:

Saturday, December 4, 2010

West Texas Interchange Crude analysis (texas tea)

Does the opening range of a market have statistical significance and can it help keep you on the right side of the market?

Using a 6 month time period for prior price pivot determinants and a 2 week opening range we can draw some conclusions I believe.

If we break the two weak opening range, and hold above for a period of half the opening range (1 week in this case) we can draw a conclusion of bias in the direction of the break. The green lines as always will determine the opening range and the blue lines will be the prior 6 month pivot which show where the meat of the market is.

Remember, what is the first question one answers before placing a bet? Where do I get out, and the answer is below if the opening range or in other words the opposite side of the initial break. So if the market goes up breaks the top of opening range and then 6 weeks later drops below the opening range, you create a bearish bias, but it has to break to a significant degree.

I'm going to start this analysis in 2005 with crude oil in 6 month increments:

Using a 6 month time period for prior price pivot determinants and a 2 week opening range we can draw some conclusions I believe.

If we break the two weak opening range, and hold above for a period of half the opening range (1 week in this case) we can draw a conclusion of bias in the direction of the break. The green lines as always will determine the opening range and the blue lines will be the prior 6 month pivot which show where the meat of the market is.

Remember, what is the first question one answers before placing a bet? Where do I get out, and the answer is below if the opening range or in other words the opposite side of the initial break. So if the market goes up breaks the top of opening range and then 6 weeks later drops below the opening range, you create a bearish bias, but it has to break to a significant degree.

I'm going to start this analysis in 2005 with crude oil in 6 month increments:

So easy even Birdman knows the secret, with his oil rig tat...He knows all about the opening range.

Can you make money off the opening range?

Subscribe to:

Posts (Atom)